The Commission has today adopted proposals for Council decisions on the signing and provisional application, as well as on the conclusion of the Association Agreement between the EU and Andorra and San Marino, respectively. This represents a key step towards the ratification of the agreement, while marking a significant milestone in EU efforts to develop a special relationship with neighbouring countries.

The Association Agreement will allow Andorra and San Marino to participate in the EU’s internal market and enhance cooperation in other policy areas. Their access to the internal market will become comparable to that enjoyed by Norway, Iceland and Liechtenstein under the Agreement on the European Economic Area. Ultimately, this responds to the two countries’ ambition in building closer relations with the EU.

The Association Agreement is based on the following key elements:

> It provides for the participation of the two countries in a homogenous extended internal market under equal conditions of competition and respect of the same rules.

> Access to the internal market in financial services will be progressive and will depend on a successful audit of the robustness of the associated States’ regulatory and supervisory frameworks. The European Supervisory Authorities will play a central role in the auditing process.

> The Association Agreement establishes a framework to develop and promote dialogue and cooperation in areas of common interest, such as research and development, education, social policy, the environment, consumer protection, culture or regional cooperation.

> It introduces a coherent, effective, and efficient institutional framework, including:

–the consistent interpretation and application of the Association Agreement in line with the case-law of the European Court of Justice; and

— a dispute settlement mechanism with the European Court of Justice as the ultimate arbiter for disputes on the interpretation and application of the Association Agreement.

> In line with the 2014 negotiating directives, the Association Agreement takes into account the particular situation of Andorra and San Marino as well as their specificities, arising from their relations of proximity with their neighbouring EU Member States, their size, including that of their populations. This is reflected in a number of adjustments as well as in several transitional periods for the implementation and application of parts of the EU acquis.

Next Steps

Once the Council gives its green light, the EU, Andorra and San Marino can sign the Association Agreement and then pass it to the European Parliament for consent. After the consent by the European Parliament, the Council can adopt a decision on its conclusion. Once Andorra and San Marino have also completed their ratification procedures, the Association Agreement can enter into force.

Background

On 16 December 2014, the General Affairs Council authorised the opening of negotiations for an Association Agreement with Andorra, Monaco and San Marino. The Commission took over the responsibility of these negotiations in January 2022.

In its conclusions adopted in June 2022, the Council called on the Commission to finalise the negotiations by the end of 2023. Between March 2022 and December 2023, 49 negotiating sessions were held and significant progress was made, leading to the conclusions of negotiations at negotiators level in December 2023.

Compliments of the European Commission.The post Commission proposes Association Agreement with Andorra and San Marino to the Council first appeared on European American Chamber of Commerce New York [EACCNY] | Your Partner for Transatlantic Business Resources.

EACC & Member News

The Commission has adopted an amendment to the 2023-24 Work Programme of Horizon Europe, the EU’s research and innovation programme. The amendment mobilises previously unallocated Horizon Europe funding to increase the 2024 budget by nearly €1.4 billion to a total of €7.3 billion. This amendment includes an investment of nearly €650 million in the EU Missions aiming to contribute to solving some of the challenges facing Europe, for example, making more than 100 cities climate neutral, a New European Bauhaus facility, as well as experimental actions opening EU research and innovation opportunities to more newcomers, among other novelties.

Some of the main features of this update of the Horizon Europe Work Programme include:

EU Missions

The EU will invest €648 million in 2024 in research and innovation activities underpinning the EU Missions. The EU Missions cover five areas and are a novelty brought by Horizon Europe to bring concrete solutions to some of our greatest challenges. They have ambitious goals and will deliver concrete results by 2030. The new actions for 2024 should result in restoring at least 25 000 km of free-flowing rivers, Climate City Contracts with more than 100 cities, 100 living labs and lighthouses leading the transition towards healthy soils, local and regional authorities better prepared to face climate-related risks, better cancer diagnosis and support to young cancer sufferers.

New European Bauhaus

The New European Bauhaus (NEB) aims to bring the benefits of the European Green Deal into people’s daily lives and living spaces. In the three years since its launch, the NEB has provided solutions to concrete problems. Examples include the TOVA project from Spain that developed a 3D printing technique with earth to provide architectural solutions for sustainable, affordable, community-based housing. Another example is the WATSUPS project from Belgium that creates a new public space alongside the river Dyle to mitigate the risk of gentrification. These solutions are rooted in research and innovation that place the Europeans at the heart of the green transformation.

A new NEB Facility will ensure that Europe continues to make most of this potential. It brings multi-annual budget support for 2025-2027 through two pillars, a research and innovation part to develop new ideas and a roll-out part to scale-up such solutions. The amended Horizon Europe work programme 2023-24 allocates €20 million to preparing the ground for the implementation of the NEB Facility.

Experimental actions to attract newcomers

This amendment includes a package of new experimental actions to reinforce the openness of the programme, support the goals of the EU Missions and foster young researchers’ careers. They will test new approaches in view of preparations for the last three years of Horizon Europe as well as of its future successor programme.

The actions include four open topics giving researchers more freedom to focus their work on a subject they choose with a total budget of €76 million in Horizon Europe Clusters addressing ‘Health’, ‘Climate, energy and mobility’ and ‘Food, Bioeconomy, Natural Resources, Agriculture and Environment’. An experimental action of €15 million for the EU Missions will make knowledge institutions such as universities or research organisations focal points of local transdisciplinary research and innovation activities with European outreach. In addition, the NEB call ‘Transforming neighbourhoods, making them beautiful, sustainable, and inclusive’ also aims to attract newcomers to the programme to maximise impact. Finally, €20 million will support talent ecosystems for attractive early research careers.

Cultural Heritage

The amendment also dedicates €48 million to the European Collaborative Cloud for Cultural Heritage. This new digital collaborative space will support cultural heritage institutions and researchers as well as the cultural and creative industries to reap the benefits of the digital transition. It will complement the common European Data Space for Cultural Heritage (the Data Space) funded under the Digital Europe programme.

Pandemic preparedness

The COVID-19 pandemic highlighted the challenges faced by European health care systems in detecting, preventing, fighting and managing outbreaks of infectious diseases. To help equip Europe for potential future pandemics, the amended work programme includes an investment of €50 million for a European Partnership for pandemic preparedness.

Paving the way for 2025

Calls for 2025 are also included in the amendment to ensure continuity of certain recurrent actions, such as the Marie Skłodowska-Curie Actions (MSCA) and ‘Teaming for Excellence’ and ‘ERA (European Research Area) Fellowships’ in the ‘Widening participation and spreading excellence’ and ‘Reforming and Enhancing the European R&I system’ part. The Commission plans to roll out the full range of actions for 2025 in a dedicated work programme in 2025.

Background

Horizon Europe is the EU’s research and innovation programme for 2021-27. Originally working with €95.5 million over seven years, the European Council decided to reduce its budget by €2.1 billion as part of the mid-term revision of the EU’s long-term budget to allow the Union to finance other urgent priorities such as aid to Ukraine. The cut has been reduced by €100 million stemming from the re-use of decommitments, therefore, the reduction in 2025-27 will amount to €2 billion.

The 2023-24 Horizon Europe work programme was adopted on 6 December 2022 and first amended on 31 March 2023. It is based on Horizon Europe’s Strategic Plan 2021-2024, adopted in March 2021, which was co-designed with stakeholders, the European Parliament and the Member States.

Today’s amendment rolls out the investment for the EU Missions, which had been held back from the original work programme 2023-24 to enable the implementation of the Communication “EU Missions two years on: assessment of progress and way forward”, adopted on 19 July 2023.

Compliments of the European Commission.The post Commission Mobilizes Research and Innovation Funding for the Green and Digital Transitions first appeared on European American Chamber of Commerce New York [EACCNY] | Your Partner for Transatlantic Business Resources.

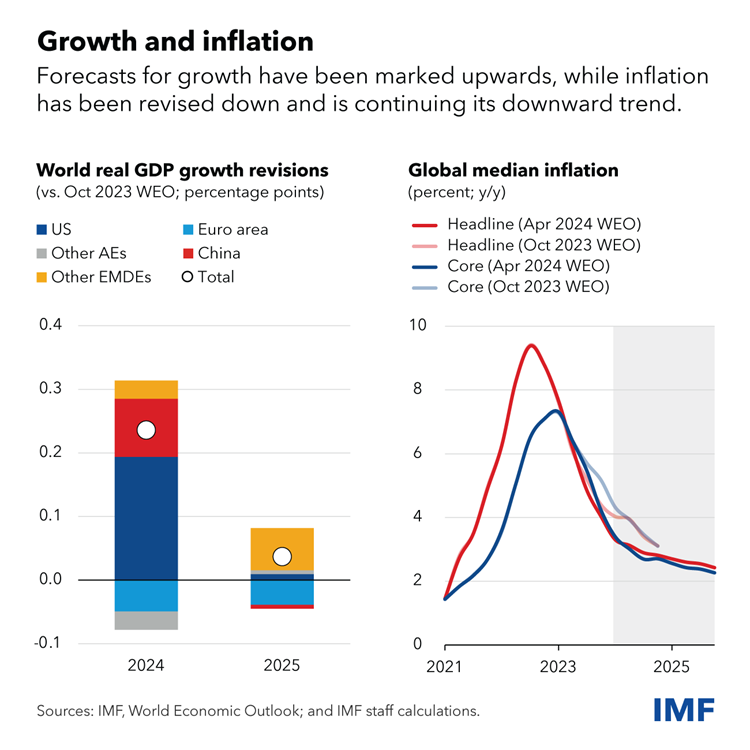

Despite gloomy predictions, the global economy remains remarkably resilient, with steady growth and inflation slowing almost as quickly as it rose. The journey has been eventful, starting with supply-chain disruptions in the aftermath of the pandemic, an energy and food crisis triggered by Russia’s war on Ukraine, a considerable surge in inflation, followed by a globally synchronized monetary policy tightening.

Global growth bottomed out at the end of 2022, at 2.3 percent, shortly after median headline inflation peaked at 9.4 percent. According to our latest World Economic Outlook projections, growth this year and next will hold steady at 3.2 percent, with median headline inflation declining from 2.8 percent at the end of 2024 to 2.4 percent at the end of 2025. Most indicators continue to point to a soft landing.

We also project less economic scarring from the crises of the past four years, although estimates vary across countries. The US economy has already surged past its prepandemic trend. But we now estimate that there will be more scarring for low-income developing countries, many of which are still struggling to turn the page from the pandemic and cost-of-living crises.

Resilient growth and rapid disinflation point toward favorable supply developments, including the fading of energy price shocks, and a striking rebound in labor supply supported by strong immigration in many advanced economies. Monetary policy actions have helped anchor inflation expectations even if its transmission may have been more muted, as fixed-rate mortgages became more prevalent.

Despite these welcome developments, numerous challenges remain, and decisive actions are needed.

Inflation risks remain

Bringing inflation back to target should remain the priority. While inflation trends are encouraging, we are not there yet. Somewhat worryingly, progress toward inflation targets has somewhat stalled since the beginning of the year. This could be a temporary setback, but there are reasons to remain vigilant. Most of the good news on inflation came from the decline in energy prices and in goods inflation. The latter has been helped by easing supply-chain frictions, as well as by the decline in Chinese export prices. But oil prices have been rising recently in part due to geopolitical tensions and services inflation remains stubbornly high. Further trade restrictions on Chinese exports could also push up goods inflation.

Economic divergences widen

The resilient global economy also masks stark divergence across countries.

The strong recent performance of the United States reflects robust productivity and employment growth, but also strong demand in an economy that remains overheated. This calls for a cautious and gradual approach to easing by the Federal Reserve. The fiscal stance, out of line with long-term fiscal sustainability, is of particular concern. It raises short-term risks to the disinflation process, as well as longer-term fiscal and financial stability risks for the global economy. Something will have to give.

Growth in the euro area will rebound but from very low levels, as past shocks, and tight monetary policy weigh on activity. Continued high wage growth and persistent services inflation could delay the return of inflation to target. However, unlike in the United States, there is little evidence of overheating, and the European Central Bank will need to carefully calibrate the pivot toward monetary easing to avoid an inflation undershoot. While labor markets appear strong, that strength could prove illusory if European firms have been hoarding labor in anticipation of a pickup in activity that does not materialize.

China’s economy remains affected by the downturn in its property sector. Credit booms and busts never resolve themselves quickly, and this one is no exception. Domestic demand will remain lackluster unless strong measures address the root cause. With depressed domestic demand, external surpluses could well rise. The risk is that this will further exacerbate trade tensions in an already fraught geopolitical environment.

Many other large emerging market economies are performing strongly, sometimes benefiting from a reconfiguration of global supply chains and rising trade tensions between China and the US. These countries’ footprint on the global economy is increasing.

Policy path

Going forward, policymakers should prioritize measures that help preserve or even enhance the resilience of the global economy.

The first such priority is to rebuild fiscal buffers. Even as inflation recedes, real interest rates remain high and sovereign debt dynamics have become less favorable. Credible fiscal consolidations can help lower funding costs, improve fiscal headroom and financial stability. Unfortunately, fiscal plans so far are insufficient and could be derailed further given the record number of elections this year.

Fiscal consolidations are never easy but it is best not to wait until markets dictate their conditions. The right approach is to start now, gradually, and credibly. Once inflation is under control, credible multiyear consolidations will help pave the way for further monetary policy easing. The successful 1993 US fiscal consolidation and monetary accommodation episode comes to mind as an example to emulate.

The second priority is to reverse the decline in medium term growth prospects. Some of that decline comes from increased misallocation of capital and labor within sectors and countries. Facilitating faster and more efficient resource allocation will boost growth. For low-income countries, structural reforms to promote domestic and foreign direct investment, and to strengthen domestic resource mobilization, will help lower borrowing costs and reduce funding needs. These countries also must improve the human capital of their large young populations, especially as the rest of the world is aging rapidly.

Artificial intelligence also gives hope for boosting productivity. It may do so, but the potential for serious disruptions in labor and financial markets is high. Harnessing the potential of AI for all will require that countries improve their digital infrastructure, invest in human capital, and coordinate on global rules of the road.

Medium-term growth prospects are also harmed by rising geoeconomic fragmentation and the surge in trade restrictive and industrial policy measures. Trade linkages are already changing as a result, with potential losses in efficiency. The net effect could well be to make the global economy less, not more, resilient. But the broader damage is to global cooperation. It is still time to reverse course.

Third, a great achievement of the past few years has been the strengthening of monetary, fiscal and financial policy frameworks especially for emerging market economies. This has helped make the global financial system more resilient and avoid a permanent resurgence of inflation. Going forward, it is essential to preserve these improvements. That includes protecting the hard-won independence of central banks.

Lastly, the green transition requires major investments. Cutting emissions is compatible with growth and activity has become much less emission-intensive in recent decades. But emissions are still rising. Much more needs to be done and done quickly. Green investment has expanded at a healthy pace in advanced economies and China. The greatest effort must now be made by other emerging market and developing economies, which must massively increase their green investment growth and reduce their fossil fuel investment. This will require technology transfer by other advanced economies and China, as well as substantial private and public financing.

On these questions, as well as on so many others, multilateral frameworks and cooperation remain essential for progress.

—This blog by Pierre-Olivier Gourinchas is based on Chapter 1 of the April 2024 World Economic Outlook.

Compliments of the IMF.The post IMF | Global Economy Remains Resilient Despite Uneven Growth, Challenges Ahead first appeared on European American Chamber of Commerce New York [EACCNY] | Your Partner for Transatlantic Business Resources.

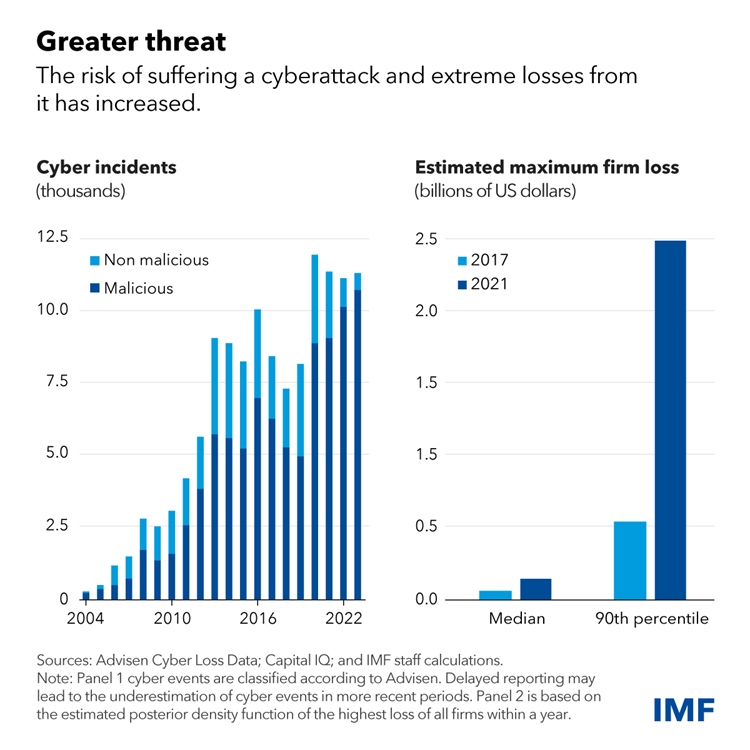

This blog is based on Chapter 3 of the IMF’s April 2024 Global Financial Stability Report | Cyberattacks have more than doubled since the pandemic. While companies have historically suffered relatively modest direct losses from cyberattacks, some have experienced a much heavier toll. US credit reporting agency Equifax, for example, paid more than $1 billion in penalties after a major data breach in 2017 that affected about 150 million consumers.

As we show in a chapter of the April 2024 Global Financial Stability Report, the risk of extreme losses from cyber incidents is increasing. Such losses could potentially cause funding problems for companies and even jeopardize their solvency. The size of these extreme losses has more than quadrupled since 2017 to $2.5 billion. And indirect losses like reputational damage or security upgrades are substantially higher.

The financial sector is uniquely exposed to cyber risk. Financial firms—given the large amounts of sensitive data and transactions they handle—are often targeted by criminals seeking to steal money or disrupt economic activity. Attacks on financial firms account for nearly one-fifth of the total, of which banks are the most exposed.

Incidents in the financial sector could threaten financial and economic stability if they erode confidence in the financial system, disrupt critical services, or cause spillovers to other institutions.

For example, a severe incident at a financial institution could undermine trust and, in extreme cases, lead to market selloffs or runs on banks. Although no significant “cyber runs” have occurred thus far, our analysis suggests modest and somewhat persistent deposit outflows have occurred at smaller US banks after a cyberattack.

Cyber incidents that disrupt critical services like payment networks could also severely affect economic activity. For example, a December attack at the Central Bank of Lesotho disrupted the national payment system, preventing transactions by domestic banks.

Another consideration is that financial firms increasingly rely on third-party IT service providers, and may do so even more with the emerging role of artificial intelligence. Such external providers can improve operational resilience, but also expose the financial industry to systemwide shocks. For example, a 2023 ransomware attack on a cloud IT service provider caused simultaneous outages at 60 US credit unions.

With the global financial system facing significant and growing cyber risks from increasing digitalization and geopolitical tensions, as shown in the chapter, policies and governance frameworks at firms must keep pace.

Because private incentives may be insufficient to address cyber risks—for example, firms may not fully account for the systemwide effects of incidents—public intervention may be necessary.

However, according to an IMF survey of central banks and supervisory authorities, cybersecurity policy frameworks, especially in emerging market and developing economies, often remain insufficient. For example, only about half of countries surveyed had a national, financial sector-focused cybersecurity strategy or dedicated cybersecurity regulations.

To strengthen resilience in the financial sector, authorities should develop an adequate national cybersecurity strategy accompanied by effective regulation and supervisory capacity that should encompass:

Periodically assessing the cybersecurity landscape and identifying potential systemic risks from interconnectedness and concentrations, including from third-party service providers.

Encouraging cyber “maturity” among financial sector firms, including board-level access to cybersecurity expertise, as supported by the chapter’s analysis which suggests that better cyber-related governance may reduce cyber risk.

Improving cyber hygiene of firms—that is, their online security and system health (such as antimalware and multifactor authentication)—and training and awareness.

Prioritizing data reporting and collection of cyber incidents, and sharing information among financial sector participants to enhance their collective preparedness.

As attacks often emanate from outside a financial firm’s home country and proceeds can be routed across borders, international cooperation is imperative to address cyber risk successfully.

While cyber incidents will occur, the financial sector needs the capacity to deliver critical business services during these disruptions. To this end, financial firms should develop, and test, response and recovery procedures and national authorities should have effective response protocols and crisis management frameworks in place.

The authors:

> Fabio Natalucci, Deputy Director of the Monetary and Capital Markets Department, IMF

> Mahvash S. Qureshi, Assistant Director and Division Chief – Monetary and Capital Markets Department, IMF

> Felix Suntheim, Deputy Division Chief in the Global Financial Stability Analysis Division – Monetary and Capital Markets Department, IMF

Compliments of the IMF.The post IMF | Rising Cyber Threats Pose Serious Concerns for Financial Stability first appeared on European American Chamber of Commerce New York [EACCNY] | Your Partner for Transatlantic Business Resources.

With Up to $6.6 Billion in Proposed CHIPS Direct Funding, TSMC Announces 2 Nanometer Technology at Second Fab and a New Third Fab to Produce 2 Nanometer or More Advanced Chips. Proposed CHIPS Investment in Arizona Would Support AI, High-Performance Computing, 5G/6G Communications, and More Applications.

On April 8th, the Biden-Harris Administration announced that the U.S. Department of Commerce and TSMC Arizona Corporation (TSMC Arizona), a subsidiary of Taiwan Semiconductor Manufacturing Company Limited (TSMC), have signed a non-binding preliminary memorandum of terms (PMT) to provide up to $6.6 billion in direct funding under the CHIPS and Science Act. This proposed funding would support TSMC’s investment of more than $65 billion in three greenfield leading-edge fabs in Phoenix, Arizona, which will manufacture the world’s most advanced semiconductors.

Through this proposed investment in TSMC Arizona, the Biden-Harris Administration would take a significant step in strengthening U.S. economic and national security by providing a reliable domestic supply of the chips that will underpin the future economy, powering the AI boom and other fast-growing industries like consumer electronics, automotive, Internet of Things, and high-performance computing. After initially announcing two fabs in the U.S., TSMC Arizona is committing to build an additional third fab before the end of the decade. With this proposed funding, TSMC Arizona would be ensuring the formation of a scaled leading-edge cluster in Arizona, creating approximately 6,000 direct manufacturing jobs, more than 20,000 accumulated unique construction jobs, and tens of thousands of indirect jobs in this decade and bringing the most advanced process technology to the United States.

“Semiconductors – those tiny chips smaller than the tip of your finger – power everything from smartphones to cars to satellites and weapons systems. America invented these chips, but over time, we went from producing nearly 40% of the world’s capacity to close to 10%, and none of the most advanced chips, exposing us to significant economic and national security vulnerabilities. I was determined to turn that around, and thanks to my CHIPS and Science Act – a key part of my Investing in America agenda – semiconductor manufacturing and jobs are making a comeback,” said President Joe Biden. “TSMC’s renewed commitment to the United States, and its investment in Arizona represent a broader story for semiconductor manufacturing that’s made in America and with the strong support of America’s leading technology firms to build the products we rely on every day.”

“One of the key goals of President Biden’s CHIPS and Science Act was to bring the most advanced chip manufacturing in the world to the U.S., and with this announcement and TSMC’s increased investment in their Arizona campus, we are working to achieve that goal,” said U.S. Secretary of Commerce Gina Raimondo. “The leading-edge semiconductors that will be made here in Arizona are foundational to the technology that will define global economic and national security in the 21st century, including AI and high-performance computing. Thanks to President Biden’s leadership and TSMC’s continued investments in U.S. semiconductor manufacturing, this proposed funding would help make our supply chains more secure and create thousands of good-quality construction and manufacturing jobs for Arizonans.”

“America’s ability to maintain our competitive edge in advanced technologies like artificial intelligence is essential to igniting the next generation of research, innovation, development, and production,” said Under Secretary of Commerce for Standards and Technology and National Institute of Standards and Technology Director Laurie E. Locascio. “Our proposed support for TSMC Arizona represents an inflection point for America’s innovative capacity that would restore our nation’s leadership in an industry that is foundational to the U.S. and global digital economy.”

“The proposed funding from the CHIPS and Science Act would provide TSMC the opportunity to make this unprecedented investment and to offer our foundry service of the most advanced manufacturing technologies in the United States,” said TSMC Chairman Dr. Mark Liu. “Our U.S. operations allow us to better support our U.S. customers, which include several of the world’s leading technology companies. Our U.S. operations will also expand our capability to trailblaze future advancements in semiconductor technology.”

“We are honored to support our customers who have been pioneers in mobile, artificial intelligence and high-performance computing, whether in chip design, hardware systems or software, algorithms, and large language models,” said TSMC CEO Dr. C.C. Wei. “They are the innovators driving demand for the most advanced silicon that TSMC can provide. As their foundry partner, we will help them unleash their innovations by increasing capacity for leading-edge technology through TSMC Arizona. We are thrilled by the progress of our Arizona site to date and are committed to its long-term success.”

TSMC is widely recognized as a global leader in semiconductor manufacturing, having pioneered the pure-play foundry business model in 1987, and now manufactures over 90% of the world’s leading-edge logic chips. In Arizona, TSMC’s three fabs are expected to bring a suite of the most advanced process node technologies to the United States: the first fab will produce 4nm FinFET process technologies; today, TSMC Arizona announced that the second fab will produce the world’s most advanced 2nm nanosheet process technology, in addition to previously announced plans to produce 3nm process technologies; and TSMC Arizona’s third fab will produce 2nm or more advanced process technologies depending on customer demand. At full capacity, TSMC Arizona’s three fabs would manufacture tens of millions of leading-edge chips that will power products like 5G/6G smartphones, autonomous vehicles, and AI datacenter servers. TSMC Arizona expects to begin high-volume production in their first fab in the U.S. by the first half of 2025.

Thanks to investments like those at TSMC Arizona, the United States is now on track to produce roughly 20% of the world’s leading-edge chips by 2030. With total capital expenditures of more than $65 billion, TSMC Arizona’s investment is the largest foreign direct investment in a greenfield project in U.S. history. TSMC Arizona’s investment in the United States is catalyzing meaningful investment across the supply chain, including from 14 direct suppliers that plan to construct or expand plants in Arizona or other parts of the U.S., further strengthening U.S. domestic supply chain resilience.

TSMC’s advanced chips are the backbone of core processing units (“CPUs”) for servers in large-scale datacenters and of specialized graphic processing units (“GPUs”) used for machine learning. Through the proposed funding for TSMC Arizona, the United States would onshore the critical hardware manufacturing capabilities that underpin AI’s deep language learning algorithms and inferencing techniques. This would help strengthen America’s competitive edge in science and technology innovation. Furthermore, through its Arizona fabs, TSMC will be able to better support its key customers, including U.S. companies AMD, Apple, Nvidia, and Qualcomm, among others, by addressing their leading-edge capacity demand, mitigating supply chain concerns, and enabling them to compete effectively in the ongoing digital transformation era. With the proposed incentives, TSMC Arizona has also committed to support the development of advanced packaging capabilities – the next frontier of technology innovation for chip manufacturing – through its partners in the U.S., creating the opportunity for TSMC Arizona’s customers to be able to purchase advanced chips that are made entirely on U.S. soil.

The PMT also proposes $50 million in dedicated funding to develop the company’s semiconductor and construction workforce. To build the long-term construction workforce needed to support these projects, TSMC Arizona recently signed an agreement with the Arizona Building and Construction Trades Council. The company also plans to utilize registered apprenticeship programs to meet a 15 percent apprenticeship utilization rate on the Phoenix construction site.

As part of its commitment to developing local talent, TSMC Arizona established one of the first state-supported Registered Apprenticeship programs for semiconductor technicians, with support from the City of Phoenix. TSMC’s U.S.-based recruiting team is also actively collaborating with university engineering programs around the country, including Arizona State University, University of Arizona, and Purdue University, and is partnering with Maricopa Community Colleges and career technical education programs on initiatives to develop the skills for a career in the semiconductor industry. Site employees have access to discounts, reimbursements, and priority enrollment through partnerships for local area early education and childcare centers.

In addition to the proposed direct funding of up to $6.6 billion, the CHIPS Program Office would make approximately $5 billion of proposed loans – which is part of the $75 billion in loan authority provided by the CHIPS and Science Act – available to TSMC Arizona under the PMT. The company has indicated that it is planning to claim the Department of the Treasury’s Investment Tax Credit, which is expected to be up to 25% of qualified capital expenditures.

As explained in its first Notice of Funding Opportunity, the Department may offer applicants a PMT on a non-binding basis after satisfactory completion of the merit review of a full application. The PMT outlines key terms for a potential CHIPS incentives award, including the amount and form of the award. The award amounts are subject to due diligence and negotiation of a long-form term sheet and award documents and are conditional on the achievement of certain milestones. After the PMT is signed, the Department begins a comprehensive due diligence process on the proposed projects and continues negotiating or refining certain terms with the applicant. The terms contained in the long-form term sheet and the final award documents may differ from the terms of the PMT being announced today.

To learn more about CHIPS for America, visit www.chips.gov.

Compliments of the U.S. Department of Commerce.

The post Biden-Harris Administration Announces Preliminary Terms with TSMC, Expanded Investment from Company to Bring World’s Most Advanced Leading-Edge Technology to the U.S. first appeared on European American Chamber of Commerce New York [EACCNY] | Your Partner for Transatlantic Business Resources.

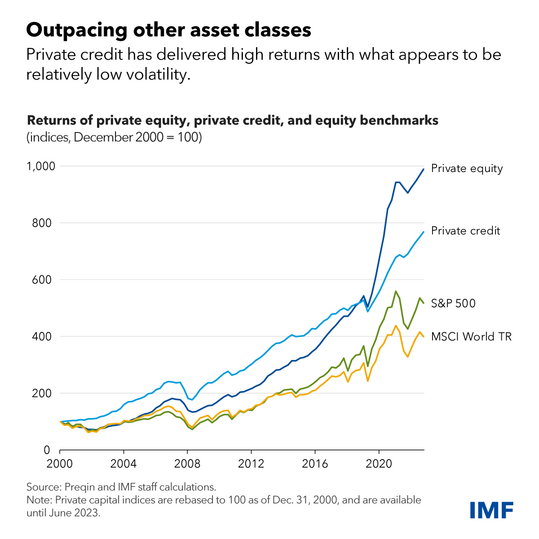

Blog post by Charles Cohen, Caio Ferreira, Fabio Natalucci, Nobuyasu Sugimoto | The private credit market, in which specialized non-bank financial institutions such as investment funds lend to corporate borrowers, topped $2.1 trillion globally last year in assets and committed capital. About three-quarters of this was in the United States, where its market share is nearing that of syndicated loans and high-yield bonds.

This market emerged about three decades ago as a financing source for companies too large or risky for commercial banks and too small to raise debt in public markets. In the past few years, it has grown rapidly as features such as, speed, flexibility, and attentiveness have proved valuable to borrowers. Institutional investors such as pension funds and insurance companies have eagerly invested in funds that, though illiquid, offered higher returns and less volatility.

Private corporate credit has created significant economic benefits by providing long-term financing to corporate borrowers. However, the migration of this lending from regulated banks and more transparent public markets to the more opaque world of private credit creates potential risks. Valuation is infrequent, credit quality isn’t always clear or easy to assess, and it’s hard to understand how systemic risks may be building given the less than clear interconnections between private credit funds, private equity firms, commercial banks, and investors.

Today, immediate financial stability risks from private credit appear to be limited. However, given that this ecosystem is opaque and highly interconnected, and if fast growth continues with limited oversight, existing vulnerabilities could become a systemic risk for the broader financial system.

We identify a number of fragilities in our April 2024 Global Financial Stability Report.

First, companies that tap the private credit market tend to be smaller and carry more debt than their counterparts with leveraged loans or public bonds. This makes them more vulnerable to rising rates and economic downturns. With the recent rise in benchmark interest rates, our analysis indicates that more than one-third of borrowers now have interest costs exceeding their current earnings.

The rapid growth of private credit has recently spurred increased competition from banks on large transactions. This in turn has put pressure on private credit providers to deploy capital, leading to weaker underwriting standards and looser loan covenants—some signs of which have already been noted by supervisory authorities.

Second, private market loans rarely trade, and therefore can’t be valued using market prices. Instead, they are often marked only quarterly using risk models, and may suffer from stale and subjective valuations across funds. Our analysis comparing private credit to leveraged loans (which trade regularly in a more liquid and transparent market) shows that, despite having lower credit quality, private credit assets tend to have smaller markdowns during times of stress.

Third, while private credit fund leverage appears to be low, the potential for multiple layers of hidden leverage within the private credit ecosystem does raise concerns given the lack of data. Leverage is deployed also by investors in these funds and by the borrowers themselves. This layering of leverage makes it difficult to assess potential systemic vulnerabilities of this market.

Fourth, there appears to be a significant degree of interconnectedness in the private credit ecosystem. While banks do not seem to have a material exposure to private credit in aggregate—the Federal Reserve has estimated that US private credit borrowing amounted to less than about $200 billion, less than 1 percent of US bank assets—some banks may have concentrated exposures to the sector. In addition, a select group of pension funds and insurers are diving deeper into private credit waters, significantly upping their share of these less-liquid assets. This includes private-equity-influenced life insurance companies, as we discussed in a recent report.

Finally, though liquidity risks appear limited today, a growing retail presence may alter this assessment. Private credit funds use long-term capital lockups and impose constraints on investor redemptions to align the investment horizon with the underlying illiquid assets. But new funds targeted at individual investors may have higher redemption risks. Although these risks are mitigated by liquidity management tools (such as gates and fixed redemption periods), they have not been tested in a severe runoff scenario.

Overall, although these vulnerabilities currently they do not pose a systemic risk to the broader financial sector, they may continue to build, with implications for the economy. In a severe downturn, credit quality could deteriorate sharply, spurring defaults and significant losses. Opacity could make these losses hard to assess. Banks could curb lending to private credit funds, retail funds could face large redemptions, and private credit funds and their institutional investors could experience liquidity strains. Significant interconnectedness could affect public markets, as insurance companies and pension funds may be forced to sell more liquid assets.

The cumulative effect of these links may have significant economic implications should stress in private credit markets result in a pullback from lending to companies. Severe data gaps make monitoring these vulnerabilities across financial markets and institutions more difficult and may delay proper risk assessment by policymakers and investors.

Policy implications

It is imperative to adopt a more vigilant regulatory and supervisory posture to monitor and assess risks in this market.

Authorities should consider a more active supervisory and regulatory approach to private credit, focusing on monitoring and risk management, leverage, interconnectedness, and concentration of exposures.

Authorities should enhance cooperation across industries and national borders to address data gaps and make risk assessments more consistent across financial sectors.

Regulators should improve reporting standards and data collection to better monitor private credit’s growth and its implications for financial stability.

Securities regulators should pay close attention to liquidity and conduct risk in private credit funds, especially retail, that may face higher redemption risks. Regulators should implement recommendations on product design and liquidity management from the Financial Stability Board and the International Organization of Securities Commissions.

—This blog is based on Chapter 2 of the April 2024 Global Financial Stability Report: “The Rise and Risks of Private Credit.”

Compliments of the IMF.The post IMF | Fast-Growing $2 Trillion Private Credit Market Warrants Closer Watch first appeared on European American Chamber of Commerce New York [EACCNY] | Your Partner for Transatlantic Business Resources.

The sixth ministerial meeting of the Trade and Technology Council (“TTC”) took place in Leuven, Belgium, on 4 and 5 April 2024. It was co-chaired by European Commission Executive Vice President Margrethe Vestager, European Commission Executive Vice President Valdis Dombrovskis, United States Secretary of State Antony Blinken, United States Secretary of Commerce Gina Raimondo, and United States Trade Representative Katherine Tai, joined by European Commissioner Thierry Breton, and hosted by the Belgian Presidency of the Council of the European Union.

The meeting took place against the backdrop of significant geopolitical developments and challenges, including Russia’s unprovoked and unjustified war of aggression against Ukraine and the escalation of violence in the Middle East, that have shaken the international rules-based order to which we are jointly committed. The European Union and the United States remain unwavering in our long-term political, financial, humanitarian, and military support to Ukraine.

There has been a buildup of global economic pressure through extensive non-market policies and practices. This accentuates excessive and possibly high-risk dependencies of strategic supplies, tilts the level playing field, and poses a threat to our economic security, our prosperity, and the well-being of our firms, workers, and citizens.

The acceleration of the digital transformation creates unprecedented opportunities for growth and innovation but also raises numerous risks and challenges that call for accelerating our efforts to establish joint leadership and continue robust coordination on our approaches for creating rules of the road for emerging technologies, such as artificial intelligence (AI), quantum technologies, and 6G wireless communication systems. We aim to foster interoperability and support our common democratic values and the protection of human rights, while also promoting innovation. We are also dedicated to continuing to equip our workforce with the skills necessary to meet the needs created by rapidly changing technology, including AI.

The cooperation between the European Union and the United States continues to be the bedrock for dealing with such global challenges, and the TTC has played a vital role in shaping a forward-looking dialogue and facilitating unprecedented coordination and quick responses to key trade and technology related issues and developments, not least in the context of Russia’s continued aggression against Ukraine. We therefore reaffirm the importance of the TTC and will continue to refine and adapt this forum to advance our shared objectives.

We have used the TTC to address global trade challenges, strengthen our economic and trade ties, accelerate the transition to climate-neutral economies, and boost our economic security. With the Transatlantic Initiative on Sustainable Trade (TIST), the TTC is contributing to the creation of a stronger, more sustainable, and more resilient transatlantic marketplace and facilitating environmentally responsible trade in goods and technologies. We have increased cooperation on interoperability of digital trade tools as well as standardisation of critical and emerging technologies to reduce the costs of trading across the Atlantic. To boost our economic security, we continue to cooperate through the TTC to diversify strategic supply chains, including solar panels, semiconductors, and critical raw materials, and to reduce vulnerabilities, including those caused by other countries’ non-market policies and practices. We have also deepened our dialogue and cooperation on export controls and investment screening.

Working with stakeholders, we continue to use the TTC to advance the governance of critical and emerging technologies, such as AI, quantum technologies, semiconductors, biotechnology, and online platforms, including by supporting the development of rights-respecting international technical standards, codes of conduct, principles, and guidance. In particular, we call upon online platforms to ensure their services contribute to an environment that protects, empowers, and respects their users and the general public. We are working together to advance public interest research on online platforms, including to address particular societal risks, such as technology-facilitated gender-based violence. We will continue to combat foreign information manipulation and interference and to protect human rights defenders online, including in the context of elections.

We intend to continue our trade and technology cooperation as set out below.

Key Outcomes of the Sixth TTC Ministerial Meeting

Advancing Transatlantic Leadership on Critical and Emerging Technologies

Artificial Intelligence

The European Union and the United States reaffirm our commitment to a risk-based approach to artificial intelligence (AI) and to advancing safe, secure, and trustworthy AI technologies. The dedicated coordination under the TTC continues to be instrumental to implementing our respective policy approaches which aim to reap the potential benefits of AI while protecting individuals and society against its potential risks and upholding human rights.

Our exchanges confirm our joint understanding that transparency and risk mitigation are key elements to ensure the safe, secure, and trustworthy development and use of AI, and we will continue to coordinate our contributions to multilateral initiatives such as the G7, OECD, G20, Council of Europe, and UN processes to advance the responsible stewardship of AI. We encourage advanced AI developers in the United States and Europe to further the application of the Hiroshima Process International Code of Conduct for Organisations Developing Advanced AI Systems which complements our respective governance and regulatory systems.

With a view to ensuring continued and impactful cooperation on AI, leaders from the European AI Office and the United States AI Safety Institute have briefed one another on their respective approaches and mandates. These institutions today committed to establishing a Dialogue to deepen their collaboration, particularly to foster scientific information exchange among their respective scientific entities and affiliates on topics such as benchmarks, potential risks, and future technological trends.

This cooperation will contribute to making progress with the implementation of the Joint Roadmap on Evaluation and Measurement Tools for Trustworthy AI and Risk Management, which is essential to minimise divergence as appropriate in our respective emerging AI governance and regulatory systems, and to cooperate on interoperable and international standards. Following stakeholder consultations, we have further developed a list of key AI terms with mutually accepted joint definitions and published an updated version.

We are also united in our belief of the potential of AI to address some of the world’s greatest challenges. We applaud the United Nations General Assembly Plenary Resolution “Seizing the Opportunities of Safe, Secure and Trustworthy Artificial Intelligence Systems for Sustainable Development,” that has solidified a global consensus around the need to manage the risks of AI while harnessing its benefits for sustainable development and the protection and promotion of human rights.

We are advancing on the promise of AI for sustainable development in our bilateral relationship through joint research cooperation as part of the Administrative Arrangement on Artificial Intelligence and computing to address global challenges for the public good. Working groups jointly staffed by United States science agencies and European Commission departments and agencies have achieved substantial progress by defining critical milestones for deliverables in the areas of extreme weather, energy, emergency response, and reconstruction. We are also making constructive progress in health and agriculture.

We will continue to explore opportunities with our partners in the United Kingdom, Canada, and Germany in the AI for Development Donor Partnership to accelerate and align our foreign assistance in Africa to support educators, entrepreneurs, and ordinary citizens to harness the promise of AI.

Quantum

The European Union and the United States established a Quantum Task Force to address open questions on science and technology cooperation between the European Union and the United States on quantum technologies. Its primary objective is to bridge gaps in research and development (R&D) between the European Union and the United States, thereby harmonising efforts in quantum technology advancements. This includes the establishment of a shared understanding and approach to technology readiness levels, development of unified benchmarks, identification of critical components in quantum technology, and advancement of international standards.

The Task Force continues work to address key questions that are necessary to reach an agreement on launching joint actions for science and technology cooperation in quantum, such as reciprocity in openness of quantum research programs and in intellectual property rights regimes.

Post-Quantum Cryptography Coordination

The European Union and the United States affirm the importance of the rapid mobilisation to secure our digital communication networks against the threats posed by the potential for a future cryptanalytically-relevant quantum computer. Our joint work in Post Quantum Cryptography (PQC), feeding into the EU-US Cyber Dialogue, enables European Union and United States. partners to share information to understand activities in PQC standardisation and in the transition to PQC.

The Road to 6G

The European Union and the United States share the belief that advanced connectivity can facilitate a more inclusive, sustainable, and secure global economy. We concur on shared principles for the research and development of 6G wireless communication systems, and we recognise that by working together we can support the development of technologies and global technical standards for tomorrow’s critical digital infrastructure that reflect shared principles and values. We support open, global, market-driven, and inclusive multi-stakeholder approaches for the development of technical standards for secure and interoperable telecommunications equipment and services. On the road to 6G, in a geopolitical environment increasingly marked by tension and conflict, the growing requirement for security and resilience of key enabling communications technologies and critical infrastructure highlights the need to rely on trusted suppliers, to prevent vulnerabilities and dependencies, with potential downstream effects on the entire industrial ecosystem.

We delivered a 6G outlook in May 2023. In addition, the two main industry associations on each side of the Atlantic jointly developed a 6G Industry Roadmap in December 2023. The roadmap affirmed the commitment of the stakeholders to collaborate on the development of 6G networks and proposed a comprehensive set of critical strategic reflections and recommendations from academia and industry. On 26 February 2024, ten countries, including some European Union Member States concluded a joint statement on 6G.

These milestones have contributed to shaping the joint “6G vision” that we are adopting today. This vision focuses on technology challenges and research collaboration including on microelectronics; AI and cloud solutions for 6G; security and resilience; affordability and inclusiveness, sustainability and energy efficiency; openness and interoperability; efficient radio spectrum usage; and the standardisation process.

Having decided on this 6G vision, the European Union and the United States will strengthen cooperation between their research and innovation funding agencies, notably through an Administrative Arrangement signed between the United States National Science Foundation (NSF) and the Directorate‑General for Communications Networks, Content and Technology (DG Connect) of the European Commission covering collaboration in the field of 6G and Next Generation Internet technologies.

Considering the importance of developing a common vision to 6G and cooperating in the global standardisation process through standardisation organisations such as ETSI/3GPP, we also intend to develop an outreach plan with likeminded partners to support and advance the development of 6G networks.

Semiconductors

The coordination on our respective efforts to build resilient semiconductor supply chains remains crucial to the secure supply of semiconductors, which are indispensable inputs to an ever-growing range of key industry sectors, and to ensure leadership in cutting-edge technologies.

We have been cooperating fruitfully under two administrative arrangements:

A joint early warning mechanism aimed at identifying (potential) supply chain disruptions and enabling early action to address their impacts, which has already proven useful in monitoring developments in the gallium and germanium markets; and

A transparency mechanism for reciprocal sharing of information about public support provided to the semiconductor sector.

We intend to extend the two administrative arrangements for a period of three years to enable further coordination and to establish synergies between our support for investments in the semiconductor sector taking place under the European Union Chips Act and the United States CHIPS Act.

The European Union and the United States share concerns about non-market economic policies and practices that may lead to distortionary effects or excessive dependencies for mature node (“legacy”) semiconductors. On the side of the fifth TTC ministerial meeting, which took place on 30 January 2024 in Washington, D.C., we held a joint roundtable with high-level industry representatives dedicated to legacy semiconductor supply chains. Both the European Union and the United States are committed to continuing to engage closely with industry on the issue. We plan to convene further government-to-government discussions with likeminded countries on this topic in the near future. In January 2024, the United States launched an industry survey to assess the use of legacy chips in supply chains that directly or indirectly support United States national security and critical infrastructure. The European Union is also gathering information on this issue. We intend to, as appropriate, continue to collect and share non-confidential information and market intelligence about non-market policies and practices, commit to consult each other on planned actions, and may develop joint or cooperative measures to address distortionary effects on the global supply chain for legacy semiconductors.

We plan to continue working to identify research cooperation opportunities on alternatives to the use of per- and polyfluorinated substances (PFAS) in chips. For example, we plan to explore the use of AI capacities and digital twins to accelerate the discovery of suitable materials to replace PFAS in semiconductor manufacturing.

Biotechnology Cooperation to Promote the Bioeconomy and Address Global Challenges

The bioeconomy is supported by the use of foundational and widely-applicable tools and technologies (including emerging biotechnologies), which have the potential to drive innovation to address global challenges. These tools and technologies also represent an opportunity to begin developing a common international understanding of the bioeconomy and future efforts to evaluate, measure, and grow the global bioeconomy as a whole. A crucial component of this effort is establishing a shared understanding of some of the risks and vulnerabilities associated with the bioeconomy, including economic and security considerations, alongside a simultaneous commitment to enabling the safe, secure, sustainable, and responsible use of tools and technologies for bioeconomic development.

We look forward to cooperating on shared research, development, and innovation priorities through the EU-US Joint Consultative Group that will push bioeconomic development forward in ways that address the most pressing global challenges we all face.

We acknowledge the significant promise and risks associated with the integration of advanced biotechnology with other technological disciplines such as AI, information technology, nanotechnology, neurotechnology, chemistry, and medicine, which will drive innovation and have significant implications for academia, industry, and economic security. To address the potential risks associated with the convergence of these technologies, we are committed to working towards mechanisms to safeguard dual-use advanced biotechnology items and equipment.

Transatlantic Cooperation on Standards for Critical and Emerging Technologies and Clean Energy Transition

The European Union and the United States share an interest in recognising mutually compatible technical standards as a way to expand transatlantic approaches for the deployment of critical and emerging technologies that reflect our shared values.

We plan to continue to exchange information on international standardisation activities for critical and emerging technologies via the “Strategic Standardisation Information (SSI)” mechanism, as established at the second TTC ministerial meeting. Our deepened cooperation enables us to cooperate on global standards. In order to strengthen collaboration with the private sector, we organised a joint stakeholder workshop in Washington, D.C., on 17 November 2023, which identified relevant areas for transatlantic collaboration.

Together with standards development organisations and stakeholders, we have endeavoured to work towards mutually compatible standards and best practices in areas of strategic interest with the objective of avoiding unnecessarily burdensome technical trade barriers, without prejudice to the specificities and needs of our respective legal systems.

Over the last two years, our cooperation has led to tangible outcomes. We have facilitated commonly recognised international standards for the rollout of megawatt charging systems for heavy-duty vehicle charging points, and joint work of European and United States standardisation bodies on plastics recycling and additive manufacturing since the start of the TTC. Our work continues to facilitate the development of mutually recognised and compatible standards to enhance new opportunities for cooperation within our respective standardisation systems.

Following a successful round of government-to-government technical exchanges, the European Commission and United States government released a Digital Identity Mapping Exercise Report Digital Identity Mapping Exercise Report which provides the results of an initial mapping centred on the definitions, assurance levels, and references to international standards included across Revision 3 of the NIST Digital Identity Guidelines (Special Publication 800-63, Revision 3) and European Regulation (EU) No 910/2014 on electronic identification and trust services for electronic transactions in the internal market. The next phase of this project will focus on identifying potential use cases for transatlantic interoperability and cooperation with a view toward enabling the cross-border use of digital identities and wallets.

The European Union and the United States intend to continue to identify emerging technology standards that are enablers of the clean energy transition for transatlantic collaboration.

Promoting Sustainability and New Opportunities for Trade and Investment

Transatlantic Initiative on Sustainable Trade

The Transatlantic Initiative on Sustainable Trade (TIST) work programme, which we launched at the fourth TTC ministerial meeting in May 2023, has advanced our cooperation on actions to accelerate the transition to climate-neutral economies in the European Union and the United States in a mutually beneficial way. The European Union and the United States have been making progress on the different work strands under the TIST work programme and will continue to advance this work.

Building a Transatlantic Green Marketplace

Building on our strong economic links to accelerate the green transition while creating new business opportunities for our firms and good employment opportunities for our citizens is a key objective of the TIST.

On 30-31 January 2024, the European Union and the United States jointly organised the “Crafting the Transatlantic Green Marketplace” event in Washington, D.C. The event brought together representatives from the European Union and the United States business, civil society, and labour communities to engage in a series of thematic stakeholder-led discussions that focused on identifying opportunities for transatlantic collaboration to promote the transition to a more sustainable and climate-neutral economy on both sides of the Atlantic. The European Union and the United States thank the participants for their time and input. We are currently analysing the various proposals for cooperation received from the stakeholders to assess their potential to be taken forward.

In addition, the European Union and the United States will continue various efforts under the TIST umbrella, including exploring potential avenues of cooperation on conformity assessment.

Green Public Procurement

The European Union and the United States underscore that, by achieving a common understanding on green public procurement practices, we can accelerate the uptake of more sustainable and greener solutions to achieve our common environmental and climate goals.

To this end, we have issued a Joint EU-US Catalogue of Best Practices on Green Public Procurement. It will contribute to advancing sustainability objectives by identifying and promoting policy tools for accelerating the deployment of publicly financed sustainability projects in the European Union and the United States.

The Joint Catalogue presents a collection of policies, practices, and actions used across all stages of the procurement process, from the strategic planning to pre-procurement, procurement, and post-contract award stage, and addresses all types of environmental and climate challenges, such as reduction of greenhouse gas emissions, energy efficiency or promoting circular economy approaches. It can serve as an inspiration for policymakers and suppliers, as well as provide ideas for the uptake of green solutions in public procurement globally.

The European Union and the United States will continue to work together on how to use the Joint Catalogue and maximise its impact.

Secure and Sustainable Supply Chains for the Clean Energy Transition

The European Union and the United States reaffirm that secure and sustainable transatlantic supply chains are key for a solid and steadfast transition towards a net-zero economy and will help reduce excessive dependencies in strategic economic activities. We intend to continue to cooperate on strategic supply chains, such as solar, to help us increase secure supply of clean energy. The European Union and the United States share common challenges in the solar sector and reaffirm the importance of a dedicated workstream that explores ways to jointly support our photovoltaic manufacturing capacity (including equipment) and to diversify and de-risk this supply chain.

The European Union and the United States also continue efforts to promote transparency and traceability to improve social standards and environmental protections across supply chains that support the green transition. In this context, we are planning a workshop with stakeholders to present ongoing initiatives to promote innovative solutions in the management of sustainable supply chains, including a focused session on solar.

EU-US Clean Energy Incentives Dialogue

The European Union and the United States share a strong commitment to tackling the climate crisis. We want to further the growth of the global clean energy economy while establishing resilient, secure, and diverse clean energy supply chains. By strengthening and expanding clean energy industries and investing in future-oriented sectors, we generate jobs, ignite a positive cycle of innovation, and decrease costs for clean energy technologies.

Through the EU-US Clean Energy Incentives Dialogue, we continue to work in a transparent and mutually reinforcing manner, to avoid zero-sum competition, subsidy races and distortions in transatlantic trade and investment flows that could arise from our respective policies and incentives. In this way, we strive to maximise clean energy technology deployment that creates jobs and does not lead to windfalls for private interests. To further enhance transparency, we intend to share specific information about our respective public incentive programs starting with one sector as a pilot with the possibility to extend this to further sectors in the future and will explore putting in place a reciprocal mechanism for consultations.

We share concerns about a range of third-country non-market policies and practices. We have discussed those used by certain third countries to attain a dominant global position in clean energy sectors, and recognise the value of continuing to exchange information on such non-market policies and practices. We will continue to explore policy tools and possible coordinated action to address harm caused by these policies and practices, including by fostering supply chain diversification, reducing dependencies, and building resilience to economic coercion.

Critical Minerals

The European Union and the United States affirm their close collaboration on diversifying global critical minerals supply chains. We welcome the launch of the Mineral Security Partnership (MSP) Forum, which we will co-chair. The MSP Forum will formalise and expand its existing engagements with minerals producing countries, with a particular focus on advancing and accelerating individual projects with high environmental protections and social governance and labour standards and promoting discussion of policies that contribute to diverse and resilient supply chains.

Continuing our well-established cooperation on critical raw materials, a workshop on “Developing the permanent magnets value chain” resulted in valuable exchanges focussing on rare earth magnets. We plan to continue these exchanges in the future.

To promote a green transition, enhance economic security, and strengthen environmental protections and labour rights in international critical minerals supply chains, the European Union and the United States are advancing negotiations toward a Critical Minerals Agreement.

Transatlantic E-Mobility Cooperation

We welcome the successful completion of the Electro-mobility and Interoperability with Smart Grids workstream with the publication of the EU-US joint technical recommendations for “Future Public Demonstrations of Vehicle-Grid Integration (VGI) Pilots.” Devised in consultation with industry experts and stakeholders, the recommendations propose the development of best practices to prepare for large-scale VGI demonstrations, educate potential customers, and incorporate requisite customer-related factors in demonstration programme designs, and aim at supporting communication and coordination between the European Union and the United States.

The recommendations complement the “Transatlantic Technical Recommendations for Government Funded Implementation of Electric Vehicle Charging Infrastructure,” which were presented at the fourth TTC ministerial meeting in May 2023 in Luleå, Sweden.

Together, the two sets of recommendations can benefit companies and end users, and transatlantic trade and investment, by supporting the expansion of e-mobility as well as the realisation of European Union and United States clean energy and decarbonisation commitments.

Enhancing eInvoicing Interoperability between the European Union and the United States

As part of our efforts to increase the use of digital tools that enhance trade, electronic invoicing (eInvoicing) has emerged as a transformative tool in modern business, offering efficiency gains, cost savings, and trade benefits. The continued cooperation and efforts towards compatible eInvoicing between the European Union and the United States offer a spectrum of advantages, with the potential to significantly reshape cross-market transactions and the dynamics of transatlantic trade. Even though most of the eInvoicing technical specifications and profiles are highly aligned, there are differences between our respective eInvoicing systems. We intend to continue to cooperate and coordinate for greater compatibility, particularly in terms of business and technical interoperability, as outlined in the declaration annexed to this Joint Statement.

Trade and Labour in the Green Transition

Today, the European Union and the United States held their third session of the tripartite Transatlantic Trade and Labour Dialogue (TALD). This session brought together TTC principals and senior representatives from labour, business, and government from both sides of the Atlantic and continued the joint transatlantic work with social partners on the promotion of sustainable and responsible supply chains with strong protections for labour rights. Building on the discussions during the workshop on the “Promotion of Good Quality Jobs for a Successful, Just and Inclusive Green Transition” on 30 January 2024, the TALD meeting provided the opportunity to dive deeper and hear views from labour and business stakeholders on the topic of the green transition, with specific focus on the green transition and other challenges, and the future of the TALD.

In addition, the European Union and the United States reaffirmed their commitment to cooperate to eliminate forced labour from global supply chains, as called upon in the labour and business stakeholders’ May 2023 joint recommendations, and they expressed the intention to continue technical dialogue to exchange information, as well as share best practices regarding the implementation of their forced labour policies, including with regard to research and risk assessment.

Trade, Security, and Economic Prosperity

Trade for Economic Security

Strengthening our economic security is a fundamental pillar of the transatlantic partnership. The TTC has helped provide a better understanding of our respective approaches to economic security. We intend to continue cooperation under the TTC to address common challenges using relevant trade and technology tools, bilaterally and in relevant fora, including the G7 and the World Trade Organisation. We reaffirm shared concerns about the challenges posed to our economic security by, among other issues, economic coercion, the weaponisation of economic dependencies, and the use of non-market policies and practices by third countries. We share the objective of continuing efforts to de-risk and diversify our trade and investment relations, including by reducing critical and excessive dependencies and strengthening the resilience of strategic supply chains.

Cooperation on Export Controls and Sanction-Related Export Restrictions

We continue to recognise the important role played by the TTC in supporting the European Union, the United States, and other international partners in their unprecedented cooperation on measures against Russia and Belarus. Such cooperation has helped bring about a continuous alignment of our regulations and a consistent application of export restrictions targeting Russia and Belarus through, for example, regular exchanges of information about authorisation and denial decisions. It has also supported coordination to counter the circumvention of our measures, such as through the creation and update of a common list of high-priority items (CHP) and our outreach to industry.

We will continue to work to further align European Union and United States priorities on Russian export restrictions and coordinated international messaging on those priorities to combat circumvention and improve efficiency and effectiveness of domestic controls. As regards the implementation of export restrictions against Russia, both sides welcome the setting up of the platform for the exchange of licensing information and plan to continue to exchange information on outreach activities, including to third countries and industry.

Both sides have also decided to continue work on facilitating secure high-technology trade and reducing administrative burdens in areas covered by export controls by developing a common understanding of respective rules and mapping out measures that would help streamline this trade, while maintaining a well-functioning and effective export control regime. For example, the United States has expanded licencing exceptions to European Union Member States.

We welcome the impulse the TTC has given to coordinated action by the European Union and the United States in reaching out to other countries and supporting them in strengthening their export controls, for example, through the provision of secure software for the processing of licenses.

Investment Screening

We reiterate the importance of having effective foreign direct investment (FDI) screening mechanisms in place aimed at addressing national security risks in the United States and addressing threats to security and public order in the European Union. We welcome the progress in this regard and will continue to support the development and implementation of these mechanisms, while promoting an open and attractive investment environment.

We have carried out joint work to identify certain best practices on FDI screening with the intention to eventually bring these to the attention of screening authorities and stakeholders more broadly. We will soon launch a joint repository that will provide additional resources to EU Member State and United States investment screening professionals. We have deepened our cooperation on investment screening through hosting a public stakeholder event and conducting outreach to likeminded partners in the Western Balkans to support their development of effective FDI screening mechanisms and intend to continue such outreach in 2024.

We will continue our cooperation on investment screening through technical exchanges, including on investment trends impacting security risks related to specific sensitive technologies to provide a better understanding of similarities and differences in approach.

Outbound Investment Security

We recognise the importance of investment, innovation, and open economies. At the same time, we are also attentive to concerns regarding potential security threats and risks to international peace and security that may arise from certain outbound investments in a narrow set of critical technologies. Against this background, the European Union and the United States will continue to exchange information on the security risks, risk analyses, and on our respective approaches around this issue, and how to address this new challenge.

Addressing Non-Market Policies and Practices

The European Union and the United States remain concerned about the persistent use of other countries’ non-market policies and practices and the challenge they pose both to our workers and businesses and to other third-country markets. We continue to exchange on the risks that non-market policies and practices, including non-market excess capacity, pose in certain sectors and to engage with partners where appropriate.

We engaged with other countries who share our concerns about China’s non-market policies and practices in the medical devices sector, and conveyed these concerns directly to China. The European Union and the United States will continue to monitor developments in the medical devices sector.

Defending Human Rights and Values in a Changing Geopolitical Digital Environment

Protecting Information Integrity in a Pivotal Year for Democratic Resilience

The European Union and the United States reiterate our unwavering commitment to support democracies across the world. We are determined to defend human rights and will continue to call out authoritarianism. In a year marked by democratic elections around the world, we call upon all actors including governments, industry, journalists, human rights defenders, and civil society to protect and defend information integrity both online and offline.

We express our strong support for the role of free, pluralistic, and independent media in protecting information integrity. Independent media should serve as a public watchdog and a key pillar of democracy, as well as an important and dynamic part of our economy. We recognise its indispensable role for informing public opinion, fact-checking, and holding those in power accountable.

We are witnessing rapid technological advancements which provide opportunities to enhance information integrity but also create new risks. The European Union and the United States share the concern that malign use of AI applications, such as the creation of harmful “deepfakes,” poses new risks, including to further the spread and targeting of foreign information manipulation and interference (FIMI). We call upon technology companies and online platforms to uphold information integrity, including in the run-up to elections across the world.